What Happens If You Don’t Have Funeral Insurance?

- t3rryinfo

- May 8, 2025

- 4 min read

Updated: Sep 12, 2025

Losing someone you love is hard. But trying to plan a funeral without any financial protection in place? That turns grief into crisis.

Funeral costs in the U.S. are steep—and rising fast. Without funeral insurance, families are often left to cover thousands of dollars out-of-pocket, navigate probate delays, and scramble for public or private help. In this article, we break down exactly what happens when there’s no funeral insurance, and how it compares to having a plan in place.

We’ll cover the real-world costs, legal responsibilities, emotional toll, and the limited help available from government programs. Plus, we’ll show you how one simple decision can protect your family from unnecessary pain.

The Rising Cost of Dying

Why funerals are more expensive than you think

In 2023, the National Funeral Directors Association reported that the median cost of a funeral with viewing and burial hit $8,300. Prefer cremation? That still runs around $6,280. Neither includes the cost of a cemetery plot, headstone, or flowers.

Here's where the money goes:

Basic service fee: ~$2,300

Casket: ~$2,500

Burial vault: ~$1,600 (often required)

Embalming and preparation: ~$775

Facility use and staff for viewing/service: ~$1,000

Transportation (hearse, limo): ~$350

Bottom Line: A traditional burial can easily surpass $10,000. And funeral costs rose nearly 6% from 2021 to 2023 alone. Learn more about what funeral insurance typically costs here.

Financial Consequences For The Family

No policy? Somebody pays—and it’s usually your family.

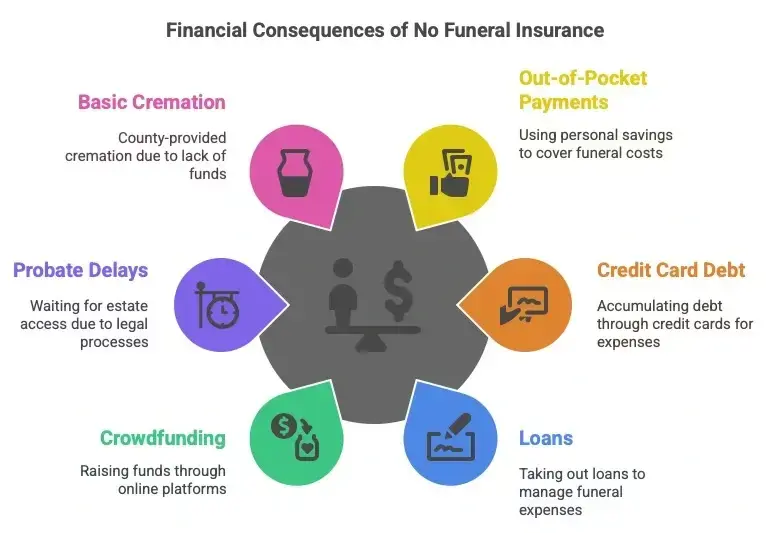

When there’s no funeral insurance in place, here’s what families face:

Out-of-pocket payments from personal savings

Credit card debt, loans, or even early retirement withdrawals

Crowdfunding through sites like GoFundMe

Probate delays, waiting weeks or months to access the estate

Basic cremation by the county if no one can pay (no service, no frills)

If a family member signs the funeral contract, they are legally liable for payment—even if they can't afford it.

Legal Obligations and Next-Of-Kin Responsibilities

The paperwork nobody wants to deal with while grieving

Each state outlines a legal hierarchy of who must arrange the funeral—starting with the spouse, then adult children, and so on. This guide from Nolo explains how most states define these responsibilities.

If no one claims the body, the county steps in to provide an indigent cremation. It’s respectful, but bare-bones. No service. No flexibility.

And even if the estate has assets, funeral expenses are priority claims in probate, which can take weeks to unlock. Meanwhile, bills are due now.

In rare cases, some states have filial responsibility laws that could make adult children liable for burial costs—though they're rarely enforced.

Emotional Toll On Loved Ones

Grief is hard. Money stress makes it worse.

When there’s no funeral insurance, emotions run even higher:

Stress and anxiety from sudden financial decisions

Guilt over "cheap" or rushed arrangements

Delays that postpone closure and healing

Family conflict over who pays what

This section is where reality hits home. It’s not just about money. It’s about the emotional trauma that money problems create during a loss.

What Help Is Available (If Any)?

Social Security, states, veterans, and the charity patchwork

There are a few limited resources:

Social Security provides a one-time $255 lump-sum death benefit to a surviving spouse or minor child.

State and county programs vary widely. For example:

Illinois: ~$1,103 funeral / $552 cremation aid

Maine: Up to $1,125 burial / $785 cremation

Georgia: County-based; some offer up to $600 for indigent cremation

Veterans may receive:

Free burial in a national cemetery

$796-$2,000 in reimbursements depending on circumstances

Churches and nonprofits may offer support on a case-by-case basis

GoFundMe and other crowdfunding platforms fill in gaps—when they succeed

But none of these cover the full cost of a typical funeral. And most require eligibility, paperwork, and time.

What A Difference Funeral Insurance Makes

Peace of mind in a policy

Funeral insurance is a small life insurance policy (‘final expense insurance’) that pays out $5,000 to $15,000 to cover end-of-life costs.

Here’s what it does:

Provides fast access to funds, often within days

Pays the funeral home directly or reimburses family

Avoids debt, probate delays, and financial stress

Prevents family conflict over money

Acts as a final act of love from the policyholder to their family

Pro Tip: A small policy with fixed rates can be one of the most affordable and compassionate ways to protect your family from unexpected hardship.

Comparison Table

Conclusion: The Hardest Question - But The Most Loving Gift

What will your family go through when you’re gone?

Without funeral insurance, your loved ones could face financial chaos, delayed goodbyes, and painful decisions during their most vulnerable moment.

But with a simple, affordable policy, you can lift that burden entirely. Funeral insurance turns tragedy into closure. Panic into peace. Cost into care.

Planning today protects your family tomorrow. It may be the most compassionate thing you ever do.

Ready to Take the Next Step?

You’ve seen what can happen without a plan—and how much easier it is with one. Don’t leave your family guessing, scrambling, or struggling. A simple funeral insurance policy can spare your loved ones from financial hardship and emotional distress when they need peace the most.

If you're ready to protect your family with a policy designed to cover final expenses, we’re here to help you explore your options—no pressure, just guidance.

👉 Click here to get a free quote or speak with someone who can walk you through your options, step by step—no pressure, just guidance.

Your family deserves clarity. You deserve peace of mind. Let’s plan ahead—together.

Frequently Asked Questions

1. What exactly is funeral insurance and how does it work?Funeral insurance is a small life insurance policy that pays out between $5,000 and $15,000 to cover funeral and burial costs. The money goes to your chosen beneficiary to use for final expenses.

2. Who is legally responsible for funeral costs if there is no insurance?Your next of kin (spouse, adult children, etc.) typically make the arrangements. If they sign the funeral contract, they become legally responsible for the bill.

3. Does Social Security help cover funeral expenses?Only minimally. The SSA provides a one-time $255 lump-sum death benefit to a surviving spouse or child.

4. What if my family can’t afford a funeral at all?Your county may provide an indigent cremation or burial. These are basic services with no ceremony.

5. Why is funeral insurance better than just saving money for final expenses?

Savings may be tied up in probate. Funeral insurance pays quickly, tax-free, and directly to your family or the funeral home.

Comments